Market Risk Analytics

Effective market and counterparty risk management will:

- Ensure the market risk is measured accurately

- Allow effective market risk management

- Save you from overly-conservative provision for counterparty risk

- Provide insights how stress scenarios affect your trading portfolio

Riskcope has various methodologies and tools to help you measure the market and counterparty risks effectively and accurately.

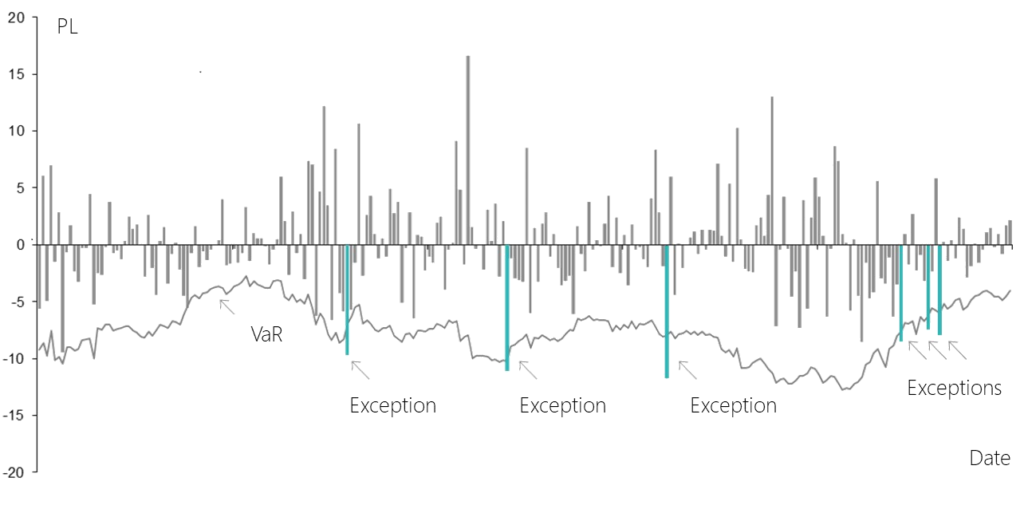

Market risk analysis provides for effective risk management various risk measures from sensitivities, statistical measure such as Value-at-Risk (VaR), to stress-testing.

Counterparty risk measurement estimates potential future loss of derivative positions for each customer. The methodology reaps the benefits from market diversification, netting agreement, and collateralization to avoid overly-conservative estimate.