Credit Risk Analytics

Effective credit risk analytics helps your business:

- Boost profit

- Reduce credit loss

- Improve collection efficiency

- Estimate expected credit loss accurately

- Explore how stress scenarios affect your credit portfolio

Riskcope has various methodologies and tools to help you assess your credit risk effectively.

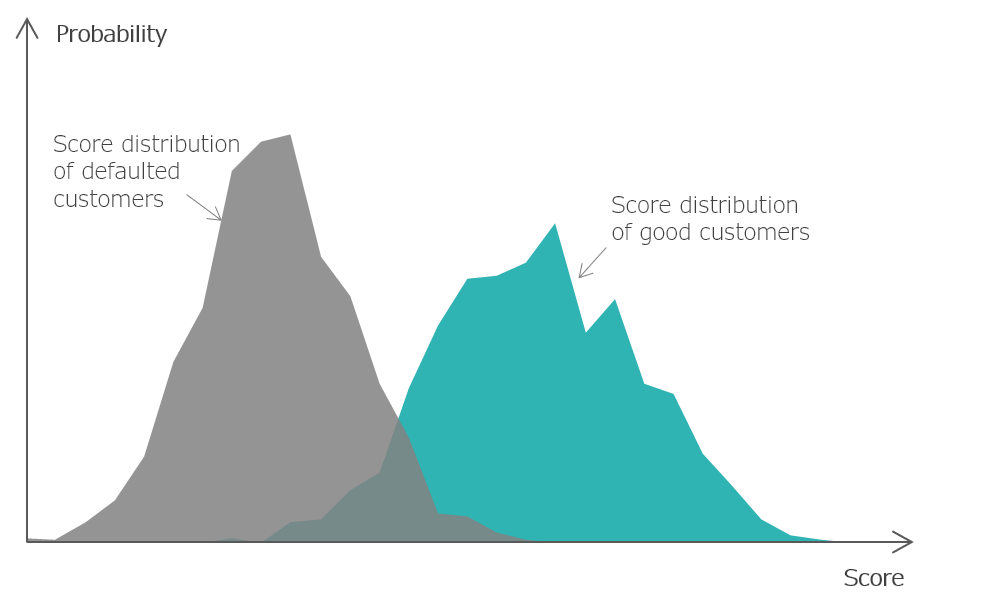

Application scorecard allows you to make an informed decision when acquiring new loans based on customer profiles.

Behavior scorecard helps you monitor the health of your customers and portfolio based on customer behaviors so that you can act early.

Collection scorecard forecasts the propensity as well as expected collection amount for each customer. So, you can prioritize your collection effort to maximize your profitability.

Optimal collection strategy helps you determine the optimal collection action for each customer to maximize your business objectives.

Expected credit loss model estimates future credit loss considering probability of default, exposure at default, loss given default and macroeconomic factors. So, you can set aside reasonable amount of provision.

Stress-testing model allows management to explore effects of adverse scenarios on credit portfolio for proactive management.