Derivative Valuation

Having your derivatives valued fairly and consistently with the market will:

- Ensure that your transactions are bought or sold at fair price

- Ensure that your balance sheet is accurately reported

Riskcope has various techniques and tools to help you determine derivative’s fair price under risk neutral pricing.

Pricing formula is suitable for vanilla products where the prices are driven mainly by market quotes

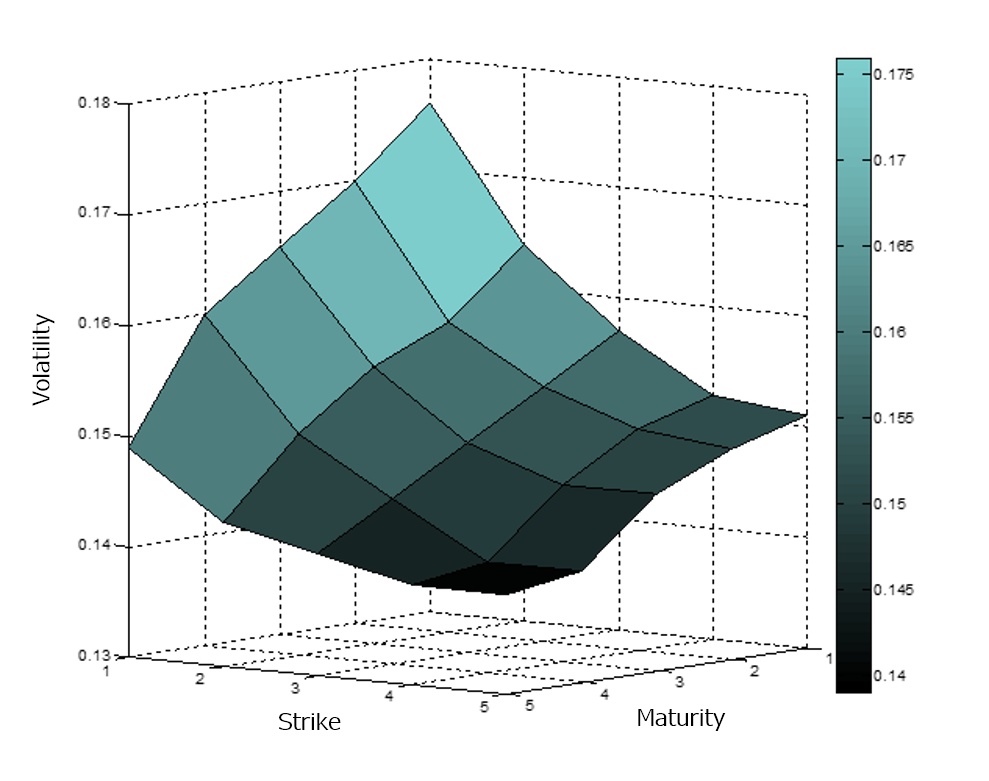

Tree simulation constructed to reproduce European options quoted in the market is suitable for pricing exotic or time-dependent options.

Monte Carlo simulation captures asset correlation and is suitable for pricing multi-asset and exotic options.